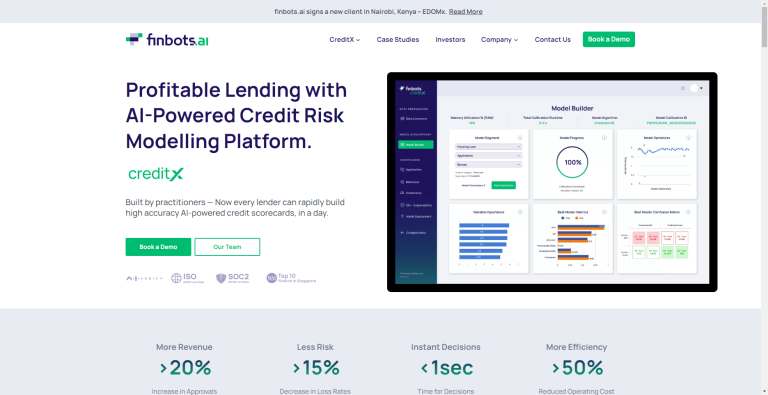

Features

- Custom Scorecards: Create highly accurate AI-powered credit scorecards tailored to meet the specific needs of your business.

- Rapid Deployment: Experience industry-leading deployment speed with our one-click, API-based process.

- Smarter Lending: Boost approvals by over 20% and reduce loss rates by over 15% through our advanced AI/ML algorithms.

- Fair, Transparent and Explainable AI: As a proud member of the AI Verify Foundation, our solutions are crafted using fair, transparent, and explainable AI.

Use Cases:

- Enhancing Lending Efficiency: CreditX simplifies lending by automating the scoring process, enabling swift and reliable decision-making.

- Facilitating Digital Transformation: Our solution accelerates the digital transformation journey for banks and credit institutions by automating their credit modelling process.

- Tailored for SMEs: Designed to meet the specific needs of small and medium businesses, promoting financial inclusion.

Finbots.ai’s CreditX stands as the next generation of credit risk modelling platforms—AI-powered, designed for speed, precision, and affordability. Trusted globally, our technology enhances revenue, minimizes risks, and promotes smarter, more efficient lending practices.